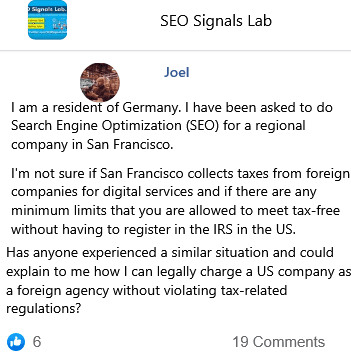

I am a resident of Germany. I have been asked to do Search Engine Optimization (SEO) for a regional company in San Francisco.

I'm not sure if San Francisco collects taxes from foreign companies for digital services and if there are any minimum limits that you are allowed to meet tax-free without having to register in the IRS in the US.

Has anyone experienced a similar situation and could explain to me how I can legally charge a US company as a foreign agency without violating tax-related regulations?

6 👍🏽619 💬🗨

📰👈

If you are not living or have your company in the U.S. you don't have to pay taxes in the U.S. there is an International Tax Facebook group where you might ask as well. I am not a Certified Public Accountant (CPA), so it is not an expert advise.

Could you please send me a link via PM. Thanks very much

Greg

Hi Joel, like Sara, I'm not a tax expert. However, I have businesses in the US.

Q: are you an employee of the SF-based company that needs SEO services, or an independent contractor? You mentioned you are an agency, so let's go with independent contractor:

All US-based companies must report contractors' wages to the Internal Revenue Service once they have reached $600 or more. We typically report it all anyway, even if $2, because why would I want to pay taxes on someone else's earnings? I want to deduct that expense from our biz taxes! I point out the $600 cutoff only to say: your new client *will* report this income to the IRS, assuming you make over $600.

However, should that bother you? As an international vendor, your new client should ask you to complete form W-8BEN so they can deduct your earnings as a business expense. But, if Germany has no international tax treaty with the United States (verify this yourself!), then you have zero tax responsibility here… unless you plan to visit the US, live here, etc. (the W-8BEN you will sign is a statement that you have no intention to visit, live, etc. in US throughout the calendar/tax year).

TL;DR: you are probably 100% fine. Unless Germany has a tax treaty with US – then you're responsible. No matter what — my opinion — you should take your own country's domestic tax responsibilities seriously and report this income.

Sure here I already cover all requirements. Before starting the deal I want get sure that I do it on both sides.

Kathy » Greg

To the best of my understanding, a non-resident alien is someone without a green card but living here. If they are conducting business here, they must be accounted for with the W-8BEN form and will pay a tax. But someone who lives in Germany and sells services to customers in the U.S. from their place of business in Germany is different. There is no tax liability here in the U.S. but that vendor must follow the laws of their own land.

Is that how you understand it?

Definition of non-resident alien here:

https://www.irs.gov/individuals/international-taxpayers/nonresident-aliensNonresident Aliens | Internal Revenue Service

Greg

Hi Kathy, that is how I understand it. I also added to the OP to look into his country's existing tax treaties, as-in my understanding-that would be the only way in which he (as neither a green card holder nor having substantial presence in the US) could have any US tax liability.

And agreed with Roy – even though the OP may have no US tax liability, his new client in the US will almost certainly require him to sign a W-8BEN so that *it* can deduct OP's income from the company's tax liability, exactly as the company will do for W-9/1099 US-based vendors/contractors.

Karen

Hey! I'm based in Scotland and have been providing SEO services in the US for a few years.

You do not need to register in the US because you're not a resident there. You would only need to pay tax if you spend more than 180 days there a year, and unless you have a visa you can't do that anyway.

What you may be asked for by companies you work for is an exemption form which is the W8-BEN form.

A US company may ask you for a W9 form (which is for independent contractors, but it's the W8-BEN that you need)

I'm happy to send you a copy and links to resources if you need them. Hope that helps!

☝️

📰👈

How important is an SEO agency to rank their Agency Site for Main Buyer Intent Keyword?

How Long Does an SEO Need to Work to Claim itself an Expert?

Should I go for an MBA or Marketing Degree to be an SEO Expert?

How to Determine Which Client Should get Marked as a Red Flag in SEO and Marketing?